Australia’s employment growth surpassed expectations for a second straight month in March, underscoring the economy’s resilience and bolstering the case for the Reserve Bank to raise interest rates again.

Article content

(Bloomberg) — Australia’s employment growth surpassed expectations for a second straight month in March, underscoring the economy’s resilience and bolstering the case for the Reserve Bank to raise interest rates again.

Advertisement 2

Article content

The currency advanced and bond yields climbed after employers added 53,000 roles — more than double economists’ estimates — driven by full-time positions, government data showed Thursday. The jobless rate held at 3.5%, hovering around a 50-year low and beating forecasts for it to increase to 3.6%.

Article content

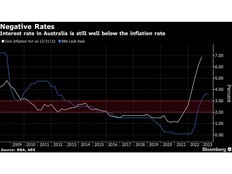

The stronger-than-expected result underlines the strength of the labor market after the RBA’s 10 straight rate rises and reinforces economists’ expectations for one more hike to take the cash rate to 3.85%. Policymakers paused hiking last week and have signaled the hurdle to further tightening may be high.

“The labor market is probably past its best but still very tight,” said Su-Lin Ong, chief economist for Australia at Royal Bank of Canada. “Today’s data likely reinforce the RBA’s tightening bias and we leave one more 25 basis-point hike in our profile.”

Article content

Advertisement 3

Article content

The Australian dollar climbed as much as 0.5% and the three-year government bond yield rose 5 basis points to 2.95%. Overnight-indexed swaps imply the RBA is all but done with tightening.

What Bloomberg Economics Says…

“Australia’s surprisingly-big surge in jobs growth in March raises the odds of a final 25-basis-point rate hike in May. The 1Q CPI report, due April 26, is the last major data point that could make or break the case for further tightening”

— James McIntyre, economist.

To read the full note, click here

The jobs data are an important piece of the puzzle for Governor Philip Lowe as he tries to assess the impact of rate rises to date. Lowe wants to hold onto employment gains after 3.5 percentage points of hikes since May last year.

Advertisement 4

Article content

The governor has said the board will closely monitor figures on inflation, jobs, consumer spending and business surveys before making a decision. Figures out Tuesday showed business sentiment remained resilient, while timely data on household spending is indicating a pullback in consumption.

If the strength in the March figures continued into April and May, Callam Pickering, senior economist at global jobs site Indeed Inc., reckons that would “greatly increase” the probability of further hikes this year.

The Labor government will welcome the employment strength that has helped boost the fiscal position over the past year. Treasurer Jim Chalmers has repeatedly said he will bank additional revenue ahead of a May 9 budget in an effort to narrow the deficit and avoid further fueling inflation.

Advertisement 5

Article content

“This is a remarkable outcome,” Chalmers said after the release. The low level of unemployment, strong jobs growth and pick up in wages “will be important factors in shielding Australians from the impacts of the worsening global economic environment.”

Labor market strength has also been a key factor in the RBA’s confidence that Australia can avoid a recession. The central bank is forecasting unemployment will hold around 3.5%-3.6% through mid-2023.

Some economists doubt the current run will last, pointing to a peak in job vacancies and faster population growth from higher immigration.

Bloomberg Economics estimates that jobs growth will need to average 2.3% a year, or 26,000 per month, to stop unemployment rising further — a tough ask at a time when the economy is forecast to slow.

Thursday’s jobs report also showed:

- The participation rate held at a revised 66.7%

- Underemployment rose to 6.2% and underutilization climbed to 9.7%

- Full-time roles jumped by 72,200, while part-time fell by 19,200

- The employment to population ratio climbed to 64.4%

—With assistance from Tomoko Sato and Matthew Burgess.

(Adds comments from economist, treasurer.)

link

Comments

Postmedia is committed to maintaining a lively but civil forum for discussion and encourage all readers to share their views on our articles. Comments may take up to an hour for moderation before appearing on the site. We ask you to keep your comments relevant and respectful. We have enabled email notifications—you will now receive an email if you receive a reply to your comment, there is an update to a comment thread you follow or if a user you follow comments. Visit our Community Guidelines for more information and details on how to adjust your email settings.

Join the Conversation